You’ve probably seen those Medicare Advantage commercials on TV featuring Joe Namath. I had been annoyed by them for a long time and assumed there was more to the story than what he was telling us. I finally got around to checking it out. He implies that Medicare Advantage plans will pay for:

- Hospitalization,

- some Home healthcare services

- Hospice care

- Doctor’s visits

- Prescription drug coverage

- Preventive care

- Dental

- Vision

- Hearing

- SilverSneakers fitness memberships

- Rides to medical appointments

- Home delivered meals

- Refunds of money previously paid into social security accounts.

He says these new benefits are at no additional cost, but the fine print says “plan premiums, co-pays, and co-insurance may apply” and for some people, costs will actually increase. Most plans require hefty copays for specialist visits.

These benefits are not available with all Medicare Advantage plans and are not available in some areas. It’s complicated. You are told to call a helpline that will tell you what plans are available in your zip code.

Healthline offers this helpful advice:

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings.

- There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

- Whether you choose original Medicare or Medicare Advantage, it’s important to review healthcare needs and Medicare options before choosing your coverage.

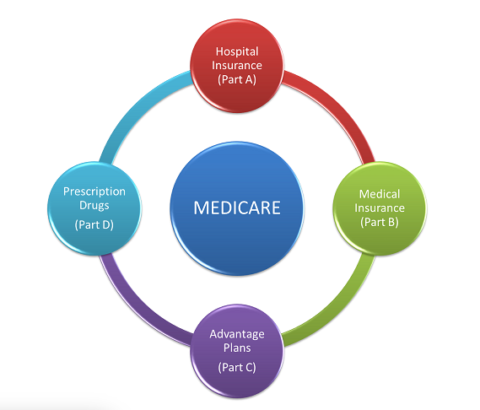

What does Medicare Advantage mean?

The plan must provide the same benefits as Medicare parts A and B but is run by a private company rather than by the government, and it may offer additional benefits beyond those of parts A and B. The government reimburses the private company according to the number of enrollees. It is also known as Medicare Part C, and it may be bundled with Part D, prescription drug coverage, which can be purchased separately by conventional Medicare enrollees. There are several types of Medicare Advantage programs, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), private fee-for service plans (PFFS), Medical Savings Accounts (MSA), and Special Needs Plans (SNPs). 43% of Medicare beneficiaries are currently enrolled in 3550 Medicare Advantage plans.

Things to consider

If you travel to another state to visit family, Medicare Advantage doesn’t go with you. You will have to pay out of pocket. Medicare Advantage plans have out-of-pocket (OOP) limits; original Medicare doesn’t.

Conclusion: Joe Namath’s commercials are misleading.

With 3550 Medical Advantage plans to choose from, and not all of them available in every zip code, choosing the right one is complicated and can be exceedingly difficult. The more I looked into this, the more confused I became. My head hurts. For the time being, I think I’ll ignore Joe Namath and stick with conventional Medicare.

Error: I was wrong to say Medicare Advantage doesn’t go with you when you travel. Some plans do; that’s one of the many things that make choosing a plan so tricky. I wouldn’t want to discourage anyone from signing up for a Medicare Advantage Plan if it really offers an advantage in their case, but it can be fiendishly difficult to figure out if it does. In my personal situation, I am covered by TriCare for Life and my meds are free. I can afford my dentist and eyeglasses, and personally it’s not worth the hassle to me to try to figure out if a Medicare Advantage Plan would save me money. If it’s that hard for me, I imagine it must be even worse for the average person. It shouldn’t be so difficult; health care in other countries is not so complicated.