Herbal remedies continue to grow in sales and popularity. But do they offer any proven health benefits?

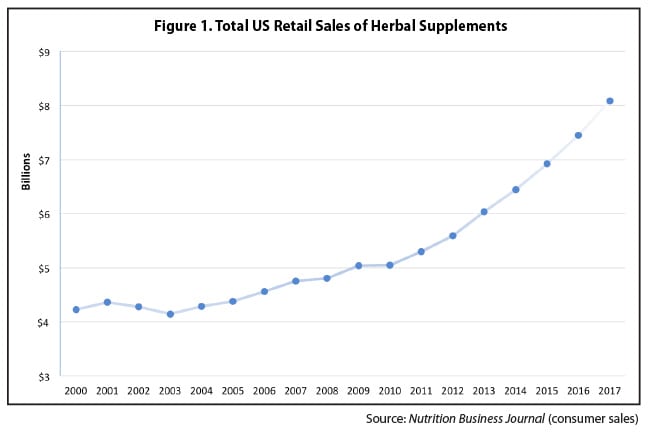

How does this business opportunity sound? A retail market that is lightly regulated with few barriers to entry. No meaningful limits on what you can say about your product, and no responsibility to actually prove your product does what it says. And this market has experienced year-over-year of growth, doubling since 2004 to almost $8 billion per year with its biggest growth ever, 8.5%, in the past year. The recently released report from the American Botanical Council paints an impressive picture of the overwhelming financial success of the natural products industry. Who wouldn’t be impressed with a sales growth chart like this?

We didn’t become widespread consumers of herbal remedies by accident. The growth in consumption has been driven by highly effective marketing based around the invented idea that these products are necessary for good health. This idea has been given credibility by regulators who have traditionally used a light hand when it comes to holding manufacturers accountable for marketing products that are safe and effective. The Dietary Supplement Health and Education Act of 1994 (DSHEA) was an amendment to the U.S. Federal Food, Drug and Cosmetic Act that established the American regulatory framework for dietary supplements such as herbal remedies. It effectively excludes manufacturers of these products from virtually all regulations that are in place for prescription and over-the-counter drugs, and puts the requirement to demonstrate harm on the FDA, rather than the onus on the manufacturer to show a product is safe and effective. The goal was to eliminate barriers to sale, and clearly, it has worked dramatically.

While many people buy their herbal products from retail outlets like health food stores and pharmacies, the strongest growth in herbal sales was direct sales, via the internet and multi-level-marketing. Direct sales accounts for a staggering half ($4 billion) of all herbal sales.

A closer look at the top 5

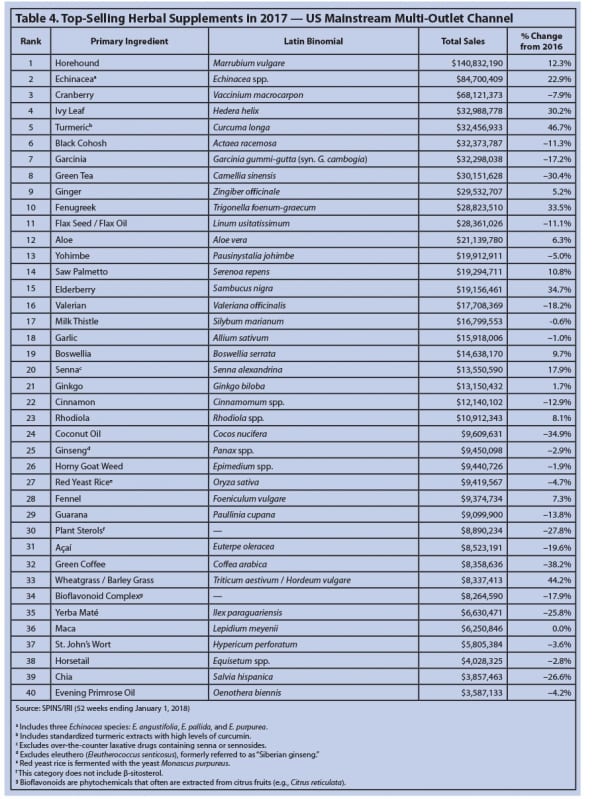

The report gives a detailed breakdown of sales and trends of individual ingredients. The top five selling products in mainstream outlets were as follows:

- Horehound (Marrubium vulgare) was the top-selling supplement ingredient in 2017 (and for the previous four years), with sales exceeding $140 million. This ingredient may not be familiar to you (it wasn’t to me) but you are probably familiar with Ricola cough lozenges, where it’s one of the several herbal ingredients. Horehound has a long history of use, and is popularly believed to have both expectorant and cough-suppressant properties (though how it could do both, simultaneously, seems implausible). There is no evidence to suggest that it in fact has these properties, or any other medicinal properties, but given the long history of use, regulators have given horehound a pass. It’s a common ingredient in “herbal” cough and cold remedies, which likely accounts for its chart-topping success.

- Echinacea comes in at #2, with $84 million in sales. Echinacea is promoted as a remedy to both prevent and treat colds and influenza. Echinacea has studied in clinical trials, using different variants of the plant, as well as different parts of the plant, and in some cases without any standardized ingredients or dosing schedules, resulting in conflicting findings that are sometimes supportive of an effect, and others that suggest no effectiveness. Overall, the strongest evidence points to the conclusion that Echinacea is likely no more effective than a comparable placebo for preventing or treating colds.

- Cranberry is a zombie of alternative medicine. There was $68 million in sales of cranberry, and it’s usually taken to prevent or treat urinary tract infections. Rigorous testing shows that it does neither. Unless you like the taste of cranberry juice, or like me, put it on your Thanksgiving turkey, there is no compelling reason to consume cranberries.

- Ivy leaf (Hedera helix) comes in at #4 with $32 million in sales. English ivy is both a groundcover and also popular supplement, and is thought to be effective for respiratory illness and infections. Ivy has been studied as a cough product for children, and there is no convincing evidence it actually has any meaningful effects.

- Turmeric rounds out the top five, with $32 million in sales and year-over-year growth of 46%. Turmeric is hot. We’ve blogged about it several times. It’s seen as some sort of magical spice, with growth fueled more by hype than any actual evidence of effectiveness. This may be due in part to the properties of the chemicals itself – it is not well absorbed and doesn’t reach any meaningful levels in the blood. But don’t think about getting an intravenous injection from a naturopath – there’s even less evidence for that, and side-effects can be fatal.

I didn’t have the time or patience to work my way through the entire list. Skimming the remainder, I could only spot a few products for which there may be reasonable scientific evidence of effectiveness, such as Senna as a laxative, or St. John’s Wort as an antidepressant.

The report notes that three herbal remedies experienced sales drops of more than 30%:

- Green coffee bean, which I have blogged about extensively was an elaborate scam promoted by credulous people like Dr. Oz. After Dr. Oz was grilled by a Senate subcommittee, which focused on his promotion of green coffee bean, the facts seem to be resonating. Green coffee bean has no useful medicinal properties.

- Coconut oil seems to have lost its time in the sun. It was initially sold as some kind of cure-all, but the evidence seems more likely that it is one of the worst oils you can consume. That advice may be resonating with consumers, thankfully.

- Green tea has been a favourite herbal remedy for decade and is a popular beverage worldwide. There is no good evidence to show it has any meaningful health benefits, but it’s considered a safe beverage to drink which is arguably much healthier than sugar-laden drinks like pop. Concentrated extracts are less clear however. Why its sales have dropped is not clear – it could be that consumers have simply moved on to other beverages that are believed to support weight loss.

What’s hot in herbals?

Glancing at the big movers gives a hint of what we might expect to see more of in the future:

- Cannabidiol (CBD), a non-intoxicating compound in Cannabis species grew in sales by over 300%. As has been blogged before, the use of medical marijuana seems to be more hype that fact at this point. With legalization (in Canada) and greater interest in actual science, I’m optimistically hoping more evidence will emerge to guide health professionals and consumers on the medicinal properties of this chemical.

- Nigella (Nigella sativa), also called black cumin or black seed, grew in sales by over 200%. It’s touted as a herbal remedy and used in Ayurvedic medicine. There are claims that can treat asthma, diabetes, digestive issues, hypertension, and more. Evidence is lacking to support use for any of these conditions.

- Moringa (Moringa oleifera) is another herbal remedy with roots in Ayurvedic medicine. It experienced sales growth of 30% and seems to be sold regularly as a powder. The report suggests that consumers may be attracted to Moringa for “general wellness and nutrition benefits”. As a food product, Moringa has been used to support nutrition programs. As a medicine, evidence is lacking it has any specific benefits or even effects./

Marketing triumphs over evidence

With herbal remedies, it’s all about the marketing, and the evidence is usually weak and occasionally nonexistent. If consumers had access to better information on efficacy and safety, would it matter? While there are signs that clear evidence of harm or non-effectiveness can resonate with consumer the overall trends in sales of this category of products suggests that evidence may not be a primary consideration to consumers. Regrettably, there is little evidence that consumers are getting much in the way of health benefit for the billions they are spending on herbal remedies annually.