Vincristine has been an important cancer drug for decades. The United States currently faces a critical shortage of this therapy.

Prescription drug shortages are occurring everyday and seem more frequent than even. As I write this post there is a critical shortage of vincristine in the United States, a drug which has a critical role in the treatment of pediatric cancers. Vincristine production was discontinued in June 2019 by Teva Pharmaceuticals for “business reasons“, leaving Pfizer as the only company producing vincristine in the country. Pfizer is now struggling to meet demand. In Canada and also in Ireland, there are critical shortages of the oral cancer drug tamoxifen, leaving pharmacists, oncologists and patients scrambling to track down limited supplies. These two shortages alone affect thousands of patients around the world. And that is just a sample of what’s current this week. The FDA lists hundreds of drugs currently in shortage, a trend that can be observed in countries like Canada and also the United Kingdom. Many countries maintain standing lists of drugs that are in short supply. Numerous survey show that pharmacists, physicians and other health care workers spend a considerable amount of their time tracking down drugs that are in short supply, or in making adjustments to treatments, sometimes forced to substitute inferior drugs, that may cost more.

I blogged about drug shortages back in 2011 and that post could have been written yesterday, with perhaps even more urgency, as the problem seems to be getting worse, not better, despite efforts to reduce them. In 2018, FDA Commissioner Scott Gottlieb established the Agency Drug Shortages Task Force to determine the root causes of drug shortages, and propose recommendations to address them. That report was released this week, and it identifies three root causes to drug shortages, with and proposes strategies to address them.

Shortages 101

What exactly is a drug shortage?

A drug shortage is a situation where the demand for a drug exceeds the supply for that drug. Shortages can be caused by a surge in demand or a reduction in supply. The primary cause of almost all drug shortages is a reduction in supply, which can sometimes cause secondary shortages through surges in demand for other products.

Why are shortages such a significant problem?

Most of the prescription drugs used in the United States, and worldwide, are generic drugs. Generic drugs have no patent protection and may have one or more manufacturers. Many generic drugs were formerly patented, with usage dating back decades. Old does not mean inferior, however, and many generic drugs that have gone into shortage are critically important and in some cases, truly lifesaving.

When the most appropriate drug for a given situation is not available, the ramifications can be severe. Surgeries can be delayed, treatments can be interrupted, and alternate therapies, potentially less effective or more expensive, may have to be used. Resolving shortages consumes the time of patients, pharmacists, physicians, and other health professionals, and can be enormously distressing to patients who simply want the appropriate therapy. Switching therapies from the preferred drug increase the risk of errors in prescribing, as well as the possibility of adverse effects, such as side effects to the substitute therapy. The full impact on patients and health systems is not well defined, but it is substantial. And to those that sit outside the healthcare system (and to many of us inside the system, too) shortages don’t make any economic sense. Why aren’t the basic rules of supply and demand working when it comes to prescriptions drugs? This is what the FDA report tries to answer.

What did the FDA’s Task Force find?

The prescription drug market is not like other markets, based on an analysis by the FDA of shortages from 2013 through 2017. While economic factors are the major reasons that shortages are occurring, the way in which drugs are manufactured and purchased today are making drug shortages more prevalent:

- Lack of incentives to produce. Manufacturers of generic drugs face substantial barriers to entry, substantial price competition, and uncertain revenue.

- Manufacturing drugs to FDA standards, particularly sterile injectable drugs, requires an enormous up-front investment, with manufacturing sites costing over USD$100 million and taking years to build and certify.

- Manufacturing cannot be scaled up or down easily, and manufacturers do not want to invest in redundant or idle equipment. Firms may choose to make more profitable drugs on the same equipment as lower-cost products.

- Purchaser consolidation, through group purchasing organizations and other buying groups, have increased negotiation power or purchasers, resulting in very low prices for generic drugs.

- Manufacturers compete almost completely on price, with a “race to the bottom”. Purchasers cannot easily assess other possible quality factors (such as reliability of manufacturing) so they are exquisitely price sensitive.

- The “costs” of drug shortages may not be borne by those that make purchasing decisions, leading to decisions that will prioritize price over manufacturing production reliability.

- The nature of bulk purchasing means that future sales are not certain, leading to challenges in forecasting revenue and profit margins, which are already low.

- The market is not rewarding manufacturers for mature quality management systems. There is little incentive for manufacturers to invest in processes and systems which reduce the risk of shortages.

- Quality management systems are business practices designed around consistency and reliability.

- Good Manufacturing Practice (GMP) assessments measure compliance with requirements, but don’t assess the resilience of manufacturing against supply and manufacturing issues.

- Supply chains are opaque, and purchasers don’t know what companies are involved in product manufacturing, from the active pharmaceutical ingredient (API) creation through final product fabrication and packaging. This complicates any “quality” assessment.

- With limited information available to purchasers, purchasers cannot assess value-added manufacturing investments, nor can they easily penalize manufacturers that fail to supply product consistently. “Failure to supply” clauses that may be in purchasing contracts are thought to be weak and ineffective, causing mainly reputational risk to manufacturers.

- Logistical and regulatory challenges make it difficult for systems to recover after disruptions

- With a smaller number of manufacturers at every stage of the pharmaceutical drug fabrication process, there are fewer competitors to step in when one manufacturer falters.

- Regulatory barriers make it difficult for new manufacturers to enter markets.

- As noted above, manufacturing facilities typically operate near capacity and cannot quickly adapt to rapid swings in demand caused by shortages.

- Almost all changes to the manufacturing process (e.g., changing API supplier) require FDA approval. As most manufacturers supply global markets, minor changes may require the approval of multiple regulators, further slowing down responsiveness.

- The costs to seek approval to market a generic drug are considerable, costing USD$1 – 5 million and taking up to give years.

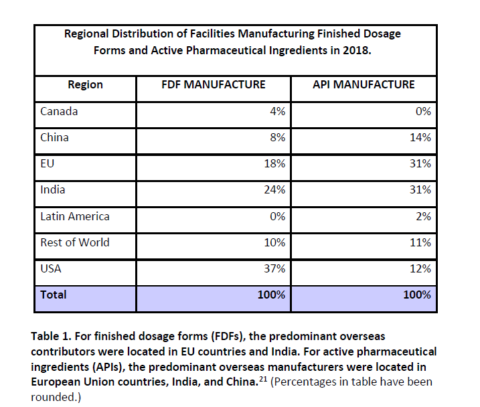

The table below shows the extent to which manufacturing of APIs is today, largely done outside North America. Even the majority of final dosage forms are now manufactured outside the U.S.:

Common questions about drug shortages

Are drug shortages caused by Obamacare/Medicare/Brexit/Government Price Controls/Group Purchasing Organizations or [insert policy here]?

No. Drug shortages are often global and are a significant problem in vastly different pharmaceutical markets (e.g., Canada vs. U.S. vs. Europe).

Would drug shortages be solved if we only had Medicare-for-all/Brexit/Pharmacare/Government Price Negotiations/More Group Purchasing or [insert policy here]?

No. With a global marketplace, global manufacturing chains, and a common reliance on cheap generic drugs to help compensate for high-cost new drugs, there is no single policy solution that can resolve drug shortages. This is a global problem.

Is Big Pharma creating the shortage so they can profit when the prices rise?

No. Almost all drugs that go into shortage situations are generic drugs, meaning there are no patents protecting them. The FDA report notes that drugs that go into shortage situations are often small components of any manufacturer’s revenue. There does not appear to be a strong financial incentive to produce these products, in some circumstances, leading to decisions to discontinue to supply them – sometimes with massive repercussions.

If that’s the case, then why do multiple manufacturers report shortages at the same time?

The recent recalls and warnings about of ranitidine (Zantac) products and valsartan (Diovan) being contaminated with N-nitrosodimethylamine (NDMA), a probable carcinogen, illustrate that just one company may produce the active pharmaceutical ingredient (API) for multiple companies. Zhejiang Huahai Pharmaceutical Co. Ltd. isn’t a name that is familiar to many, but this Chinese firm manufactured most of the valsartan chemical compound for other generic drug manufacturers, resulting in multiple brands all being found to be contaminated. For companies that didn’t have problems with the valsartan API, they couldn’t easily scale-up to address the shifting demand as contaminated products were pulled from pharmacy shelves, and a shortage situation was created.

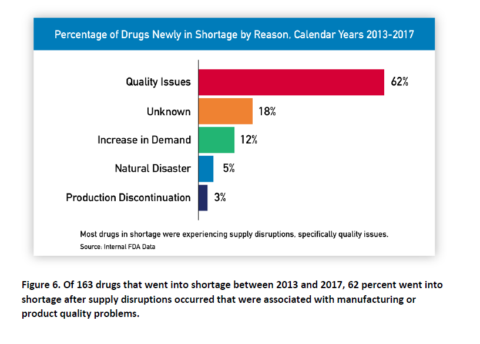

What are the causes of most shortages?

By far, the biggest cause is quality issues, as the agency notes in its report. Frustratingly, even the FDA couldn’t identify the cause in 1/5 of shortages.

What can be done about drug shortages?

The FDA’s Task Force made the following recommendations:

1. Do more to understand the impact of shortages, and how contracting may contribute to them: Collect better data on the frequency, persistence, intensity and harms of shortages, as well as the impact on patients and costs to health systems. As part of this, get better transparency on the private sector contracting practices (e.g., group-purchasing agreements with low price clauses that put contract certainty in question.)

2. Create a rating system for manufacturers to invest in quality management systems: A standardized rating system based on objective indicators could inform purchasers about a manufacturer’s commitment to processes that reduce the likelihood of shortages. This could become a consideration in purchasing, giving a competitive advantage and potential reward to companies that are more resilient and reliable.

3. Promote sustainable private sector contracting: Contracts need to provide reasonable returns to manufacturers, particularly for drugs which are of critical importance. Contracts should reward quality management systems.

Conclusion: No simple solution to drug shortages

While economic factors lie behind many of the factors that cause drug shortages, there is no easy way to address drug shortages. The FDA’s proposal to assess quality management systems is a good one, and something that realistically only the FDA could undertake. But other solutions require a fundamental rethink about our approach to buying and using generic drugs. Ultimately, without more stability and certainty in the market for manufacturers, there is likely to be continued uncertainty and instability in the marketplace for patients and consumers.